A financial planning tool

Empowering users with personalized guidance for long-term financial success

Challenge

The goal of the project was to steer Equip, an early-stage FinTech startup, in crafting a long-term product strategy and UX direction for its platform offered through employers.

After secondary and primary research, we found that 55% of employees spend 3 hours of their workweek on their finances, are 3 times more likely to change jobs when experiencing financial stress, and lack the supporting systems to take action. This led to a focus on how we might offer personalized guidance during employees’ initial steps necessary to secure their financial future, aimed at curbing procrastination and ultimately improving financial well-being.

Outcome

A validated new product feature, the Financial Roadmap, to boost the platform’s user engagement by approximately 300%, increasing platform usage from twice a year to eight times a year per user. This, coupled with a comprehensive long-term product strategy and UX direction in the form of a product and operational roadmap spanning the next 1-3 years, positioning Equip for sustained growth.

Timeline

3 months, equivalent

My role

Served as the only UX Designer on this project, orchestrating the entire design process from ideation to implementation. My responsibilities included conducting user research, defining personas, crafting journey maps, designing digital prototypes and user interface design, and developing the product- and operational roadmap, while working closely with the CEO and CTO.

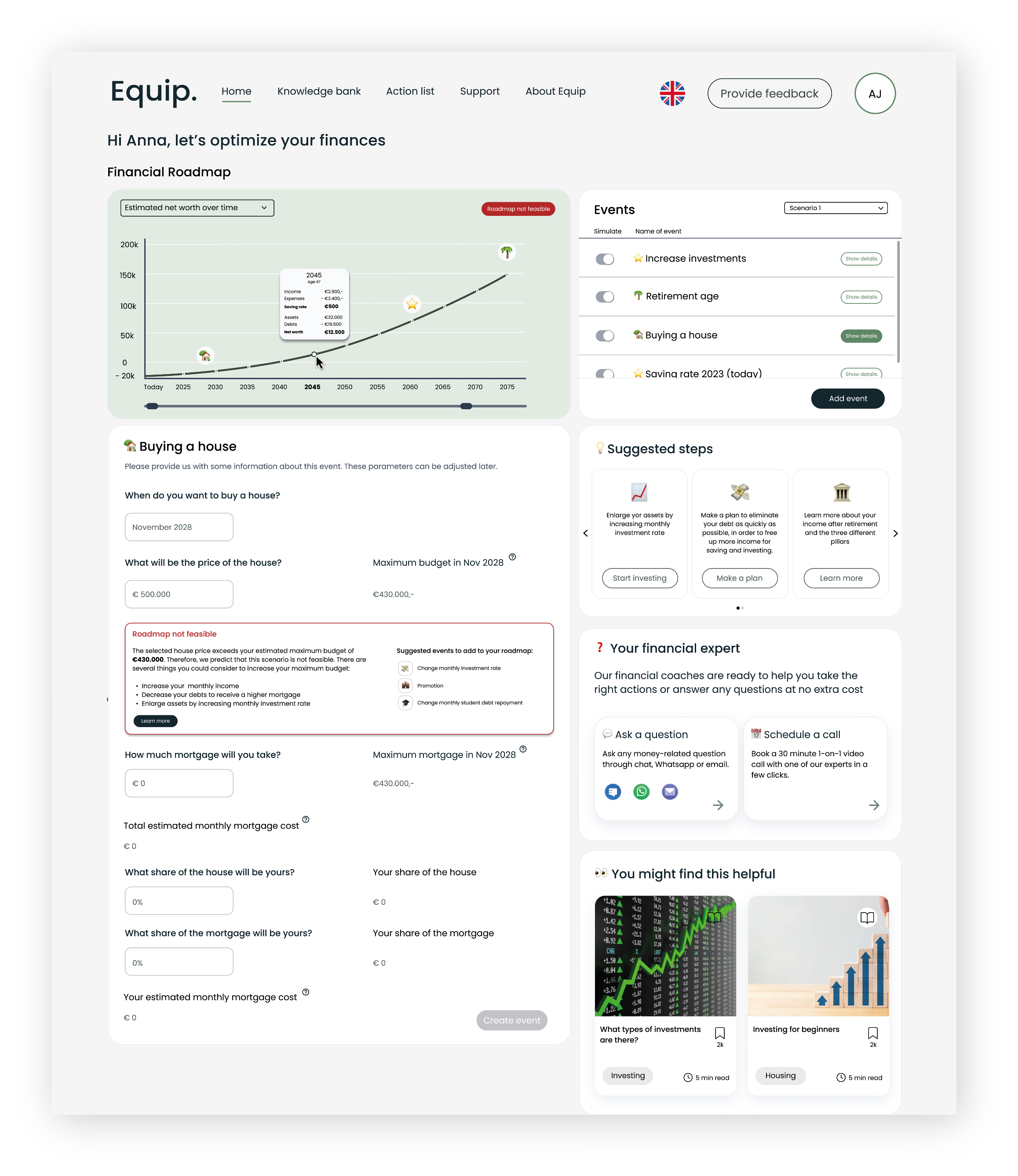

After validating the concept through user testing, I designed a Minimal Viable Product (MVP) that simulates an individual’s net worth over time. It offers the ability to create different scenarios based on financial decisions and events that could occur.

Empathize

Bringing qualitative user insights to life

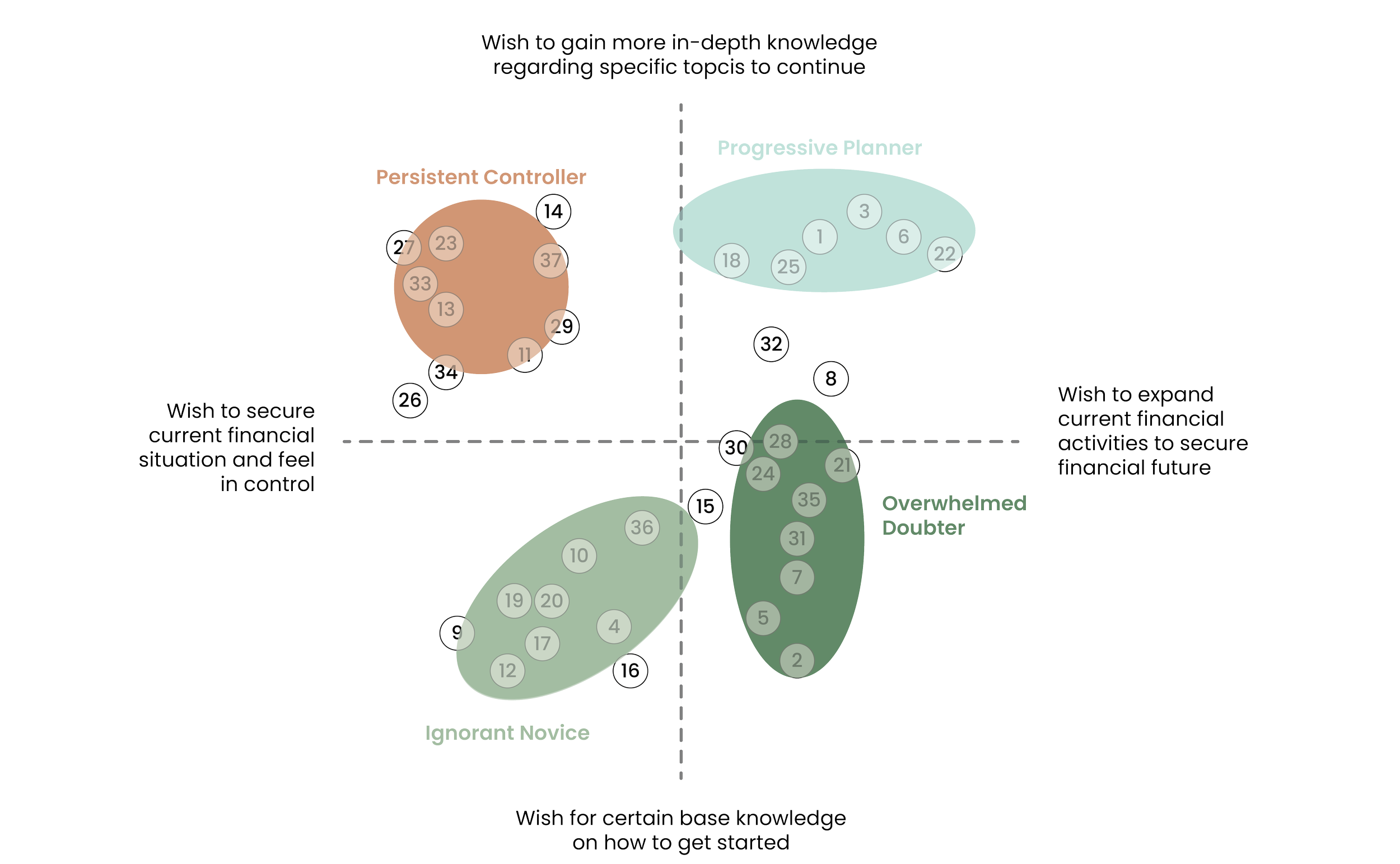

Embarking on the project, I immersed myself in uncovering the deep-seated needs of our users following preliminary secondary research. Through extensive interviews and collaborative sessions with 37 participants and 6 financial experts, insights were formulated such as:

Insight

People who just started their first job (1-2 years) are still figuring out how to deal with their money and have the tendency to compare with one another. However, they miss the total picture of each other's situation, creating a false understanding of a healthy financial situation.

User quote

”I think that we give each other the perception that we understand what a healthy financial situation is, but a lot of us actually don't know.” (Participant 36)

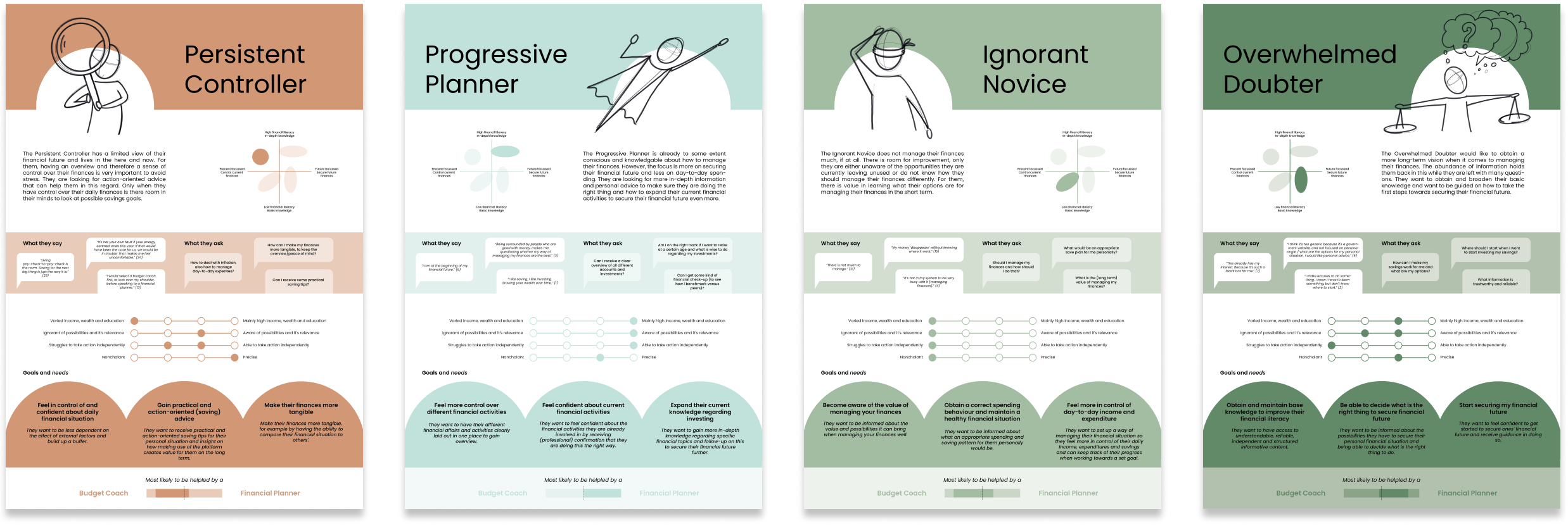

These insights were used to craft personas across two different axes, each representing a unique facet of our user base, complete with their characteristics, needs, and their own set of user stories, such as:

User story

As an Overwhelmed Doubter (persona type), I want to be informed about the possibilities to secure my personal financial situation, so I can feel confident when deciding what is the right thing to do.

Additionally, I mapped out detailed user journeys, to trace every step of the end-to-end user experience of current financial services provided by financial experts. These journeys unveiled the pain points and bottlenecks of the current processes, providing invaluable insights for Equip to focus on, such as:

Insight

The current business model and offer of Independent financial planners does not fit the younger customer base they would like to acquire since it is too complex and expensive.

Quote

”FPs are looking for other avenues of work and diversify their customer base, since it's not aligned with new customer base they want to approach (because of ageing).” (Financial Planner 1)

Define

Aligning user needs and business objectives

The personas and user journeys, emphasizing identified needs and pain points, fostered team understanding and alignment, shaping the platform’s product strategy and UX direction.

This was accomplished through an extensive team workshop facilitated by me, aimed at prioritizing user needs while aligning with business objectives (i.e. user interaction-, repeat usage-, and retention rate).

The prioritization led to a new focal point, defined as followed:

Problem statement

The Overwhelmed Doubter is an individual with low financial literacy who requires personalized guidance during the initial steps necessary to secure their financial future, as this will provide them with the confidence to get started and help mitigate procrastination.

This problem statement formed the central focus for the continuation of the design process.

Ideate

Crafting solutions with impact and feasibility

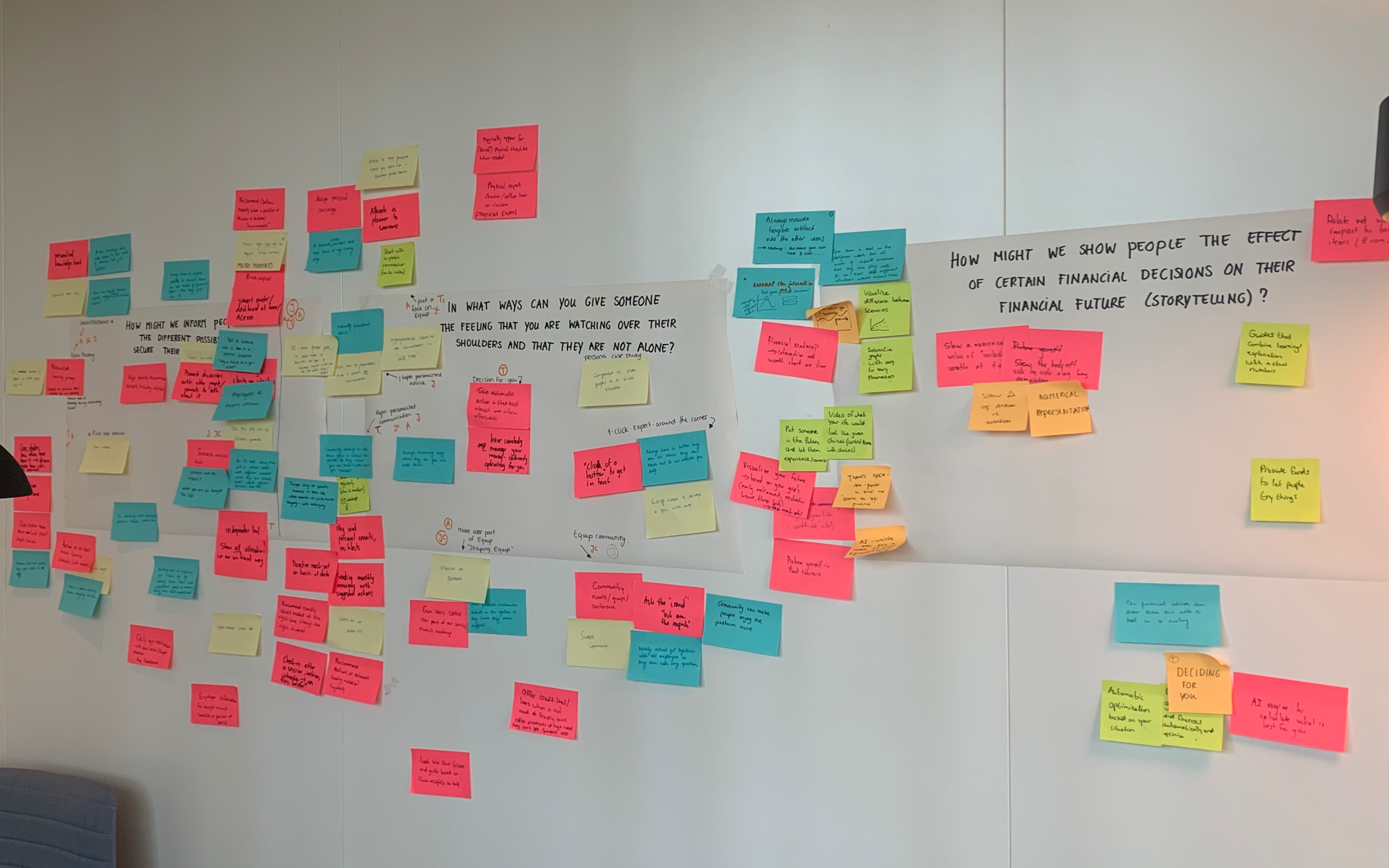

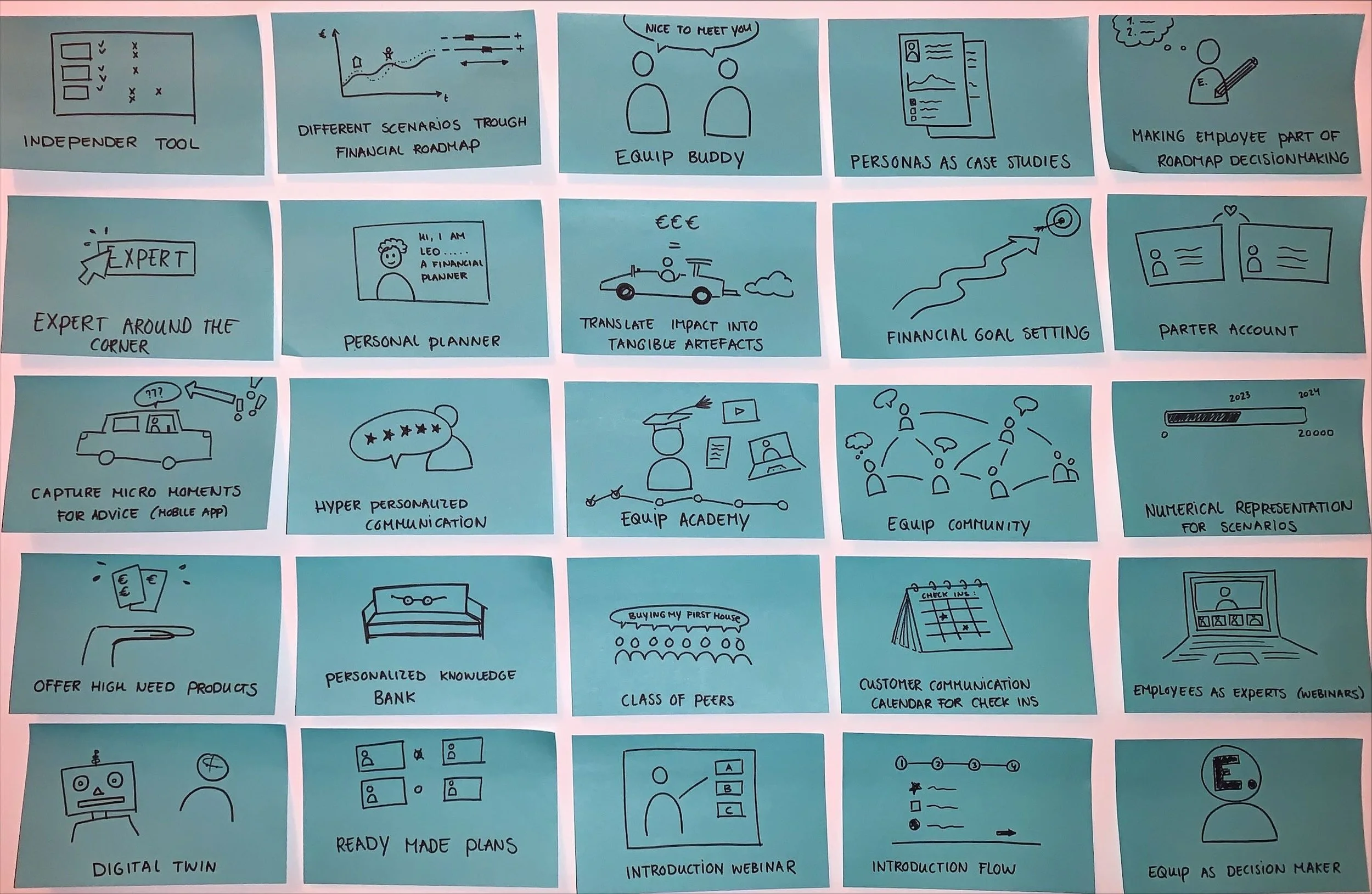

A multitude of ideas were generated through both individual and collaborative ideation sessions, utilizing various "How might we-" questions to inspire creativity. These sessions resulted in a diverse collection of initial ideas, which were then assessed based on desirability (user impact) and feasibility. Feasibility was further confirmed through discussions with one of Equip's product engineers.

Following this evaluation, four concepts, were showcased using storyboards to depict different solution scenarios. A comprehensive review of each concept's pros and cons with the team ultimately led to the decision to advance with the Financial Roadmap and Equip Talks, while discontinuing the Independer tool and Personas as case studies concepts.

I facilitated multiple brainstorm sessions with the team using brainstorm techniques such as HMW-questions and rapid sketching.

Prototype & test

From ideas to a concrete and tested solution

Next, I embarked on crafting wireframes, prototypes, and high-fidelity visual designs in Figma, despite the absence of an existing design system. The initial setup of modular components laid the groundwork for further development.

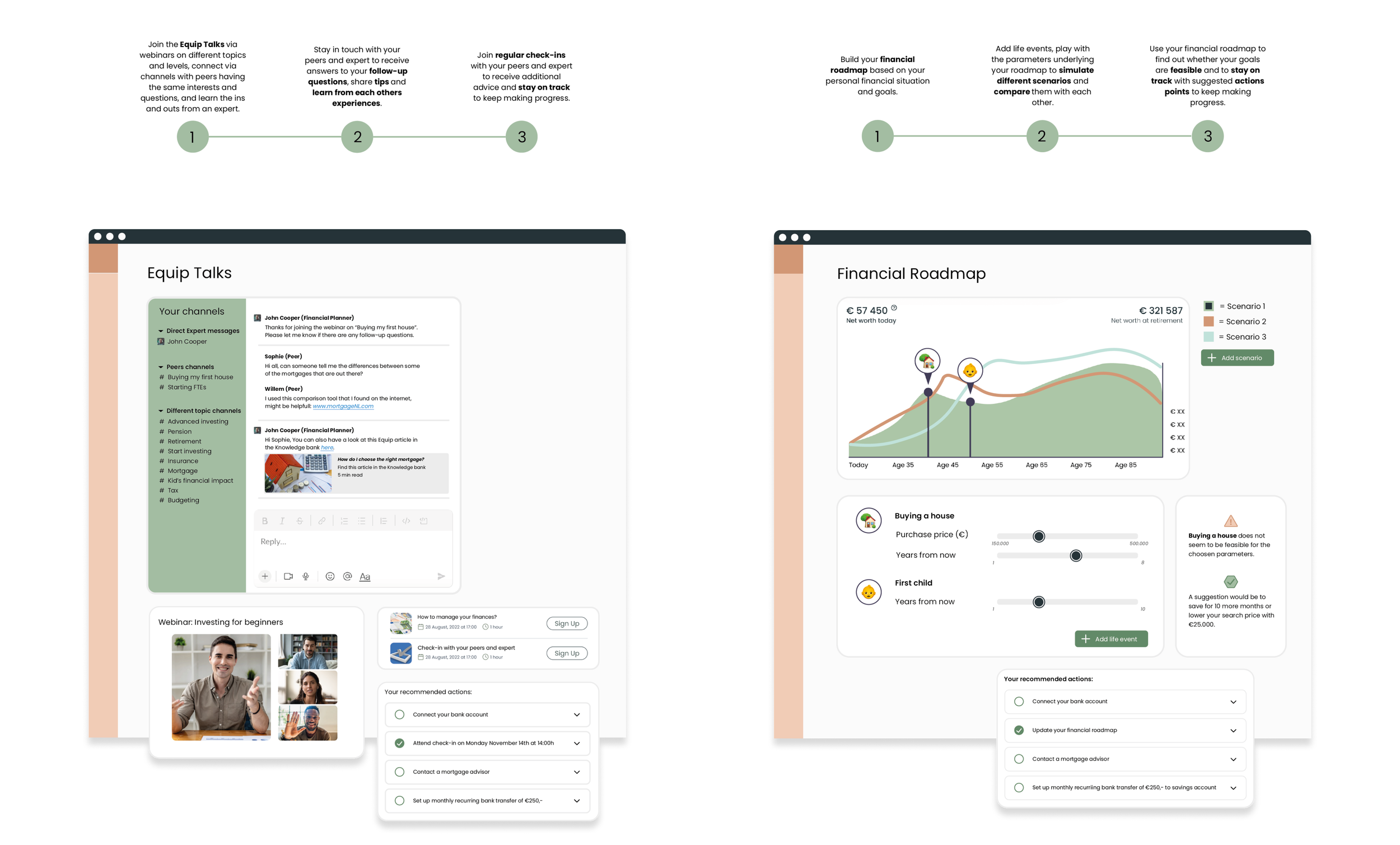

Multiple prototypes were created and user-tested to evaluate the usability and effectiveness of the selected concepts, such as A/B testing and user flow assessments. The user testing process included assessing the Financial Roadmap and Equip Talks, with the aid of designed mockups to illustrate the concepts to participants.

Insights from the user tests revealed that while the Equip Talks concept was perceived as a sufficient source of theoretical information, the Financial Roadmap was recognized as delivering significant new value to the platform by enabling users to plan for their financial future. These insights informed the definition of requirements to further develop the concept.

Some of the mockups were used to bring life to the ideas to test them with participants.

From static wireframes to interactive prototypes

Subsequently, various interactive prototypes were developed to conduct multiple user tests. Aiming to validate the Financial Roadmap's information architecture and ensure the effectiveness of data visualization in communicating complex financial information to users, demonstrating my ability to work with complex data sets and information density to create digestible user interfaces.

Iteration 1

Providing insight into user’s net worth but concluded that they missed direct feedback about their financial situation.

Iteration 2

Enabling users to experience the impact of life-changing events in real-time and receive immediate feedback but concluded that they felt overwhelmed too.

Iteration 3

Educating them on their financial situation and providing concrete next steps they can act upon, making them feel in control of their financial future.

After multiple rounds of tests, this resulted in the validation of the concept, aiming to increase the platform's user engagement by approximately 300% and defining a minimal viable product for initial development.

The insights gained during this design process were used to formulate the product strategy for the next 3 years and incorporated into a product- and operational roadmap, integrating potential new features identified through customer research.

Final design

Simulating financial decisions

The final design solution, named the Financial Roadmap, addresses the needs of the Overwhelmed Doubter (persona) by providing personalized guidance during the crucial initial steps of securing their financial future. Through this product feature, users can simulate the impact of various financial decisions, such as life events, on their financial situation over time. By visualizing these potential scenarios, users can proactively plan for their financial future, making their finances more tangible and empowering them to take action. This solution builds users' confidence to get started and helps mitigate procrastination by suggesting actionable next steps based on their individual situation.

Reflection & personal learnings

It should not be a one (wo)men’s job

1.

The intrinsic value of collaboration within a cross-functional team is paramount, providing a platform to exchange ideas and overcome obstacles. As a dedicated team player, I love working alongside passionate and creative individuals.

2.

It's crucial to differentiate between users' stated needs and their actual requirements, underscoring the need for diverse validation tests to assess both the usability of the tool (information architecture) and the relevance of the content (addressing real user needs). This iterative process involves constant refinement and adjustment.

3.

Ultimately, it's not about creating the perfect, accurate tool; it's about delivering value to your users. Sometimes, this means having to make trade-offs between business and user objectives.